Mastering Economic Events: A Comprehensive Guide to Utilising Acuity’s AI Economic Calendar

As the financial landscape morphs and evolves, Acuity’s AI Economic Calendar stands tall as a guiding beacon, shedding light on the intricate path for traders aspiring to master economic event analysis and navigate risks with precision. For Eightcap traders, this calendar proves to be an indispensable ally, offering advanced features and unique insights that empower individuals across all expertise levels. Let’s delve into the pivotal aspects of this essential resource and unravel strategies for adeptly mastering economic events.

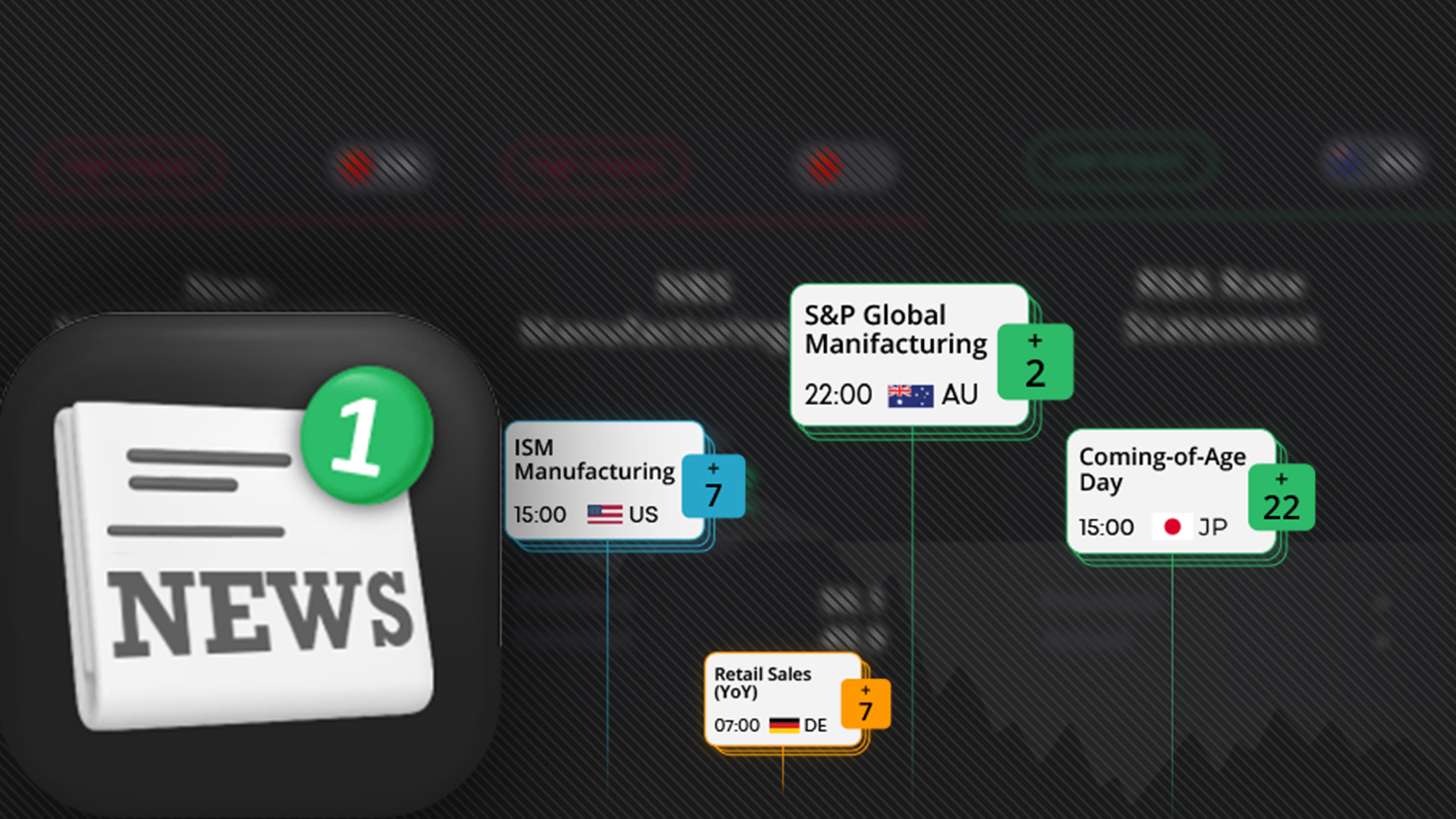

The Indispensable Economic Calendar

The Acuity AI-driven Economic Calendar, available for free in the Eightcap client portal, offers more than just a schedule of events. It’s a versatile tool designed to boost trader confidence during market volatility caused by global economic shifts. Whether your clients are seasoned traders or newcomers, this calendar proves invaluable for navigating economic events.

Advanced Filtering:

Acuity’s AI Economic Calendar stands out with its advanced filtering options. Traders can utilize traditional and alternative data filters to pinpoint high-volatility assets. This feature allows for portfolio expansion and the discovery of optimal trading opportunities around each event.

Dow Jones Integration:

Partnering with Dow Jones enriches economic data and news coverage. By merging Acuity’s AI-driven insights with Dow Jones’ extensive resources, traders gain a competitive edge in understanding market movements, providing a strategic advantage in volatile economic landscapes.

Exclusive Insights:

Acuity’s AI Economic Calendar goes further by offering exclusive data-driven insights. Traders can proactively plan strategies ahead of key economic events, optimizing positions to capitalize on opportunities and manage risk effectively. This forward-looking approach sets Acuity apart as an essential tool for precise decision-making.

Navigating the Calendar:

Understanding the economic calendar’s structure is crucial for traders to extract maximum value. Given the global nature of the forex market, a comprehensive calendar allowing custom filtering by country and currency is essential. Key elements to note include:

- Event Details: Brief descriptions, scheduled dates and times, and values for “previous,” “forecasted,” and “actual” figures.

- Market Impact: Forecasted and previous values impact market sentiment and price movements, aiding traders in anticipating reactions.

- Event Categorization: Events are typically categorized by impact level (high, medium, low), with high-impact events significantly influencing global markets.

- Timing: Ensuring alignment with local time zones to avoid miscalculations when entering or exiting the market.

Top Events to Monitor: Certain economic events significantly influence currency markets. Traders should closely monitor events such as:

- Central Bank Interest Rate Decisions

- Consumer Price Index (CPI)

- Purchasing Manager’s Index (PMI)

- US Non-Farm Payroll (NFP)

Trading Strategies: While the economic calendar provides abundant information, traders must develop effective strategies for incorporating this data into their decision-making process. A popular approach involves:

- NFP Report Trading Strategy:

- Observation Period

- Candlestick Analysis

- Directional Trade

- Risk Management

Managing Risk: High-impact news releases can lead to slippage, making risk management crucial. Traders often exit positions minutes or hours before a report release to avoid unpredictable market liquidity drops.

Alternative Data: Acuity’s AI Economic Calendar acknowledges the importance of alternative data sources in the digital age. For example, the Bank of England uses natural-language processing to analyze help-wanted ads, showcasing the potential of alternative data in understanding economic trends.

News Sentiment Analysis: Understanding market psychology is vital for traders, and news sentiment analysis provides valuable insights:

- Anticipating Market Reactions

- Empowering Retail Traders

- Acuity Sentiment Analysis Tool

- Reliable Market Signal

- Visual Cues with Acuity

Conclusion

Partnering with Eightcap opens up a world of possibilities for you and your clients. With access to Acuity’s AI Economic Calendar through Eightcap’s platform, you can empower your clients with a sophisticated tool to navigate the intricacies of economic events with confidence and precision. Provide them with advanced features and exclusive insights that enhance their trading experience and enable them to capitalise on opportunities in the ever-changing market landscape.

Join forces with Eightcap today to offer your clients the invaluable resource of Acuity, and together, let’s journey towards success amidst the perpetual changes of the trading world.

Trading on margin is high risk.

In addition to the disclaimer on our website, the material on this page does not contain a record of our trading prices, or represent an offer or solicitation for a transaction in any financial instrument. Eightcap accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Please note that past performance is not a guarantee or prediction of future performance. This communication must not be reproduced or further distributed without prior permission.

EN

EN